I spoke earlier this month with Karl Brauer, executive analyst for iSeeCars. We talked about iSeeCars’ latest EV dealers study, which found non-Tesla new EV sales grew by 800% from November 2020 to November 2023. We also chatted more broadly about the state of the electric vehicle market as 2023 draws to a close.

Our conversation was refreshing. Brauer is not an EV evangelist (EVangelist?) — he told me he’s “not close” to buying an electric vehicle himself. But he doesn’t come off as a skeptic, either. He’s just realistic about the considerable challenges non-Tesla automakers face in electrifying their fleets.

“I don’t really see any obvious benefits for any companies. Every one of them is facing some challenges,” he told Yahoo Finance’s Akiko Fujita in an interview about a week after we spoke. “You’ve got incentives issues. You’ve got market issues. You’ve got pricing issues, macroeconomic factors that are slowing down the purchase of electric vehicles.”

Brauer was kind enough to detail these issues for me, painting a picture of an electric transition that’s far more nuanced than the loudest voices on either side want to believe. The takeaway was straightforward enough, though, and not especially surprising: The median car buyer is not ready to go full electric.

Putting the “EV sales slowdown” in context

EV sales have indeed slowed in 2023 following an explosive 2022.

A slowdown is not a decline, however. The combined market share of full EVs and plug-in hybrids continues to grow, just not as rapidly as before. EVs and PHEVs should take about 9% new-car market share for full-year 2023. The monthly share reached 11% in September 2023, or more than one in every ten cars sold. EVs and PHEVs were about 7% of the new-car market in full-year 2022.

Still, 2023 year-over-year growth rates are likely to be on par with 2022’s, at best. After two big acceleration years in 2021 and 2022, EV sales growth has leveled off.

In cyclical markets for durable goods like cars, sales slowdowns can be self-correcting. As EVs pile up on dealer lots — one local Volkswagen dealer here has around 100 ID.4s in stock or transit, which seems like staggering number for a single lot — dealers add incentives to clear inventory, dropping average prices and (theoretically) juicing sales.

But it’s not yet clear that the laws of supply and demand work as efficiently in the EV market, which remains unfamiliar to most Americans.

More on that unfamiliarity in a moment. First, another important bit of context.

Consumers have more EV options now (and more places to find them)

The EV sales surge follows a dramatic increase in choice and availability.

The number of non-Tesla EV models on the U.S. market grew from about five to about 35 between November 2020 and November 2023, says Brauer. That figure will continue to increase in 2024 as a bunch of family-size options hit the market, including the Chevy Equinox and the Kia EV9.

Most dealerships have jumped onto the EV bandwagon in the past three years too. Despite pushback from dealer groups, iSeeCars finds 55.1% of new car dealers and 29.4% of used car dealers selling EVs in November 2023. In November 2020, 16.5% of new car dealers and 17.1% of used car dealers sold EVs.

Among the highest-volume dealers — those selling at least 1,001 new cars per month — 87.2% offered EV options in November 2023.

Among dealers affiliated with brands offering at least one EV model, 73.5% of new car dealers sell EVs. This indicates most dealers aren’t “hard no” on EVs. They’ll at least try to sell them if their automakers do.

The “but” — what’s holding EV sales back?

Some EV enthusiasts blame “politics” for slower-than-anticipated adoption. Are they onto something?

Yes, but “politics” is not the whole story.

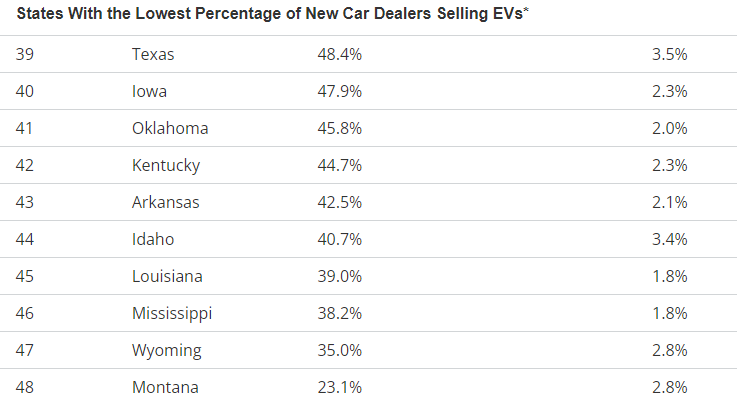

It’s true that there’s considerable geographic variation in dealer availability and overall EV market share. States where Republicans tend to do well in statewide elections also tend to lag in dealership and consumer EV adoption. iSeeCars’ bottom 10 dealer adoption states all voted for Donald Trump in the 2020 election.

A working paper put out by the Energy Institute at Haas finds similar correlation at the county level. Democratic-leaning counties have higher rates of EV adoption than Republican ones.

But a closer look at the data reveals a more nuanced picture that’s less about politics and policy than about economics and consumer behavior. iSeeCars’ study notes (and Brauer reiterated when we spoke) that states that appear to lag in EV adoption actually saw much faster EV sales and availability growth between 2020 and 2023 than more mature, and reliably blue, markets like California and Washington State.

Brauer believes “there’s this [EV] market threshold that it’s much easier to get to, then after it’s harder to grow.” In other words, markets see rapid sales growth as early adopters buy EVs. Once the early adopters are satisfied, dealers face a broadly cautious mass market.

How cautious? Here’s CNBC’s early-November summary of Cox Automotive’s days-of-supply data:

EV and internal combustion engine (ICE) inventory started the year off at about 52 days’ supply, according to Cox Automotive. Days’ supply is a way of measuring how many vehicles a dealer has on the lot. In the case of a 52 days’ supply, if automakers were to stop producing cars today, dealers would be able to keep selling cars for about that number of days before running out. Since January, EV days’ supply has skyrocketed while ICE supplies have hovered between 52 and 58 days. EV supply at the start of October was 97 days, down from the peak inventory of around 111 days during early July.

Note: “ICE” includes gas-only engines and gas-electric hybrids without plugs.

Brauer sees four friction points on the consumer side. The first is fundamental. Once it’s overcome, the other three come into play.

1. Lack of knowledge

Most drivers are aware that electric vehicles are a thing. But surprisingly few can accurately define them, let alone make informed buying decisions, says Brauer. And someone daunted by the very idea of a fully electrified car is less likely to “do the research” than simply to stick with what they know. Especially when they need to replace an old beater sooner than later.

“We tend to overestimate consumers’ familiarity with newer automotive technologies,” he says.

Brauer still encounters people who ask where to find the plug on traditional gas-electric hybrids, which use a drivetrain that has been in the automotive mainstream for going on 20 years. Brauer estimates that maybe 40% of consumers understand how gas-electric hybrids work. That leaves 60% of consumers who wouldn’t knowingly consider buying one.

Yet that’s enough to constitute “a critical mass of consumers who aren’t scared of hybrids anymore,” says Brauer. That critical mass is driving rapid growth in gas-electric hybrid sales. In the second quarter of 2023, hybrids captured 7.2% of the passenger vehicle market, up from less than 2% in the first quarter of 2019.

Because automakers are leaning into full electrification faster than they did gas-electric powertrains, the learning curve could be steeper this time around. It’s still early days, though.

2. Upfront cost

Lack of knowledge is the first and most significant winnowing, eliminating most would-be electric car owners.

The next hurdle is upfront cost. Prices for new EVs declined sharply in 2023, driven in part by increased supply and slower-than-expected demand, but electric car sticker prices generally remain higher than comparable ICE vehicles. Ironically, Chevy is discontinuing — temporarily, it says — two of the most affordable mass-market EVs, the Bolt and Bolt EUV.

EV enthusiasts like talking about “payback,” the idea that lower fuel and maintenance costs offset the upfront premium over time. Unfortunately, “payback” only comes into play once you get beyond “sticker shock,” and it seems like many new-car buyers haven’t yet. Which isn’t surprising: Higher upfront pricing is immediate and tangible, while the idea of a supposedly superior product paying for itself over time is uncertain and abstract.

3. Charging networks

Superior product, you say? In some ways, sure: EVs are more efficient, cost less to maintain, and are (arguably) more fun to drive than ICE cars. Full EVs are also more reliable than more complex plug-in hybrids, though less so than gas-only and traditional hybrids.

But on one very important measure — fueling — full EVs currently fall well short of vehicles with gas tanks.

Sure, charging at home is a breeze —once you’ve picked out a home charger, had it professionally installed, and possibly made some electrical upgrades at considerable additional expense. Even if your electric utility offers home charger rentals, you’ll likely need to pay out of pocket for any new wiring or panel upgrades, plus installation: figure $1,000 to $2,000 for an average-difficulty job, and more like $4,000 to $6,000 if you need a bigger electrical panel first.

If you go electric and stay electric, this one-time expense pays for itself eventually through lower fueling costs. The real holdup for would-be EV buyers is what to do about charging outside the home.

This is where the Tesla/non-Tesla divide really shows. Today, it is much easier to charge a Tesla on the road than any other electric vehicle make. Tesla’s multibillion-dollar Supercharger network has more than 20,000 fast-charging ports (and climbing) reserved for vehicles with Tesla’s proprietary NACS technology. Non-Tesla drivers face an alphabet soup of competing charging brands, like ChargePoint and Blink and Electrify America, all with their own apps and payment processes and usability issues. And most non-Tesla public chargers are Level 2, meaning they add just 20 or 30 miles per hour — fine for overnight charging or topping up while running errands, but not filling up when you’re trying to make time on a road trip.

This gulf will begin to narrow in 2024 as a federally funded public fast-charger buildout kicks into gear and non-Tesla automakers switch new vehicles to the NACS standard while outfitting existing vehicles with NACS-compatible adapters. As it stands right now, though, a non-Tesla is a tough sell for anyone who plans by necessity to charge outside the home.

4. Versatility

That brings up the final hurdle for would-be EV buyers: the fact that full-electric vehicles can’t address every single use case that gas-only, gas-electric hybrid, and even plug-in hybrids can.

This is largely down to range and charging time. An EV with a nameplate range of 200 to 300 miles doesn’t travel as far on a full charge as a gas vehicle does on a full tank. A robust charging network can take the sting out of range anxiety, but that still leaves charging time. No EV goes from 0% to 100% (or 10% to 80%, for that matter) as quickly as a gas vehicle refills. Some are downright pokey, taking an hour or longer to fully charge even at the fastest chargers around. (The issue isn’t the charger but the maximum voltage the vehicle accepts.)

This leaves even a significant proportion of EV-ready buyers hesitant to fully electrify their fleets. They’ll buy an EV if they have a gas vehicle (a “real car,” Brauer calls it) as a road-trip backup and if they can easily charge at home, but they aren’t going all-in.

Brauer and I didn’t talk at length about what might change this equation. I’d imagine more efficient batteries that charge a bit faster will help, as will denser and less confusing fast-charging infrastructure. But EVs might never charge as quickly as gas vehicles fill up. Which means road-trippers will need to tweak their behavior a bit — spending more time smelling the roses (or eating, or scrolling) at charging stops.